It’s really hard to navigate the ever-changing regulatory landscape in the world of financial services while enabling advisors to grow. But recently, testimonial marketing has received a lot of attention.

In your position as a compliance officer, you may find it difficult to create a standard operating procedure (SOP) around testimonial marketing, but I believe it’s crucial. Today, online reviews are helping millions of consumers make more informed hiring decisions as a result of the marketing rule.

Your advisors are eager to grow, but you need to ensure they grow compliantly. So we’re here to help you strike that balance with testimonial marketing.

To this end, Wealthtender CEO Brian Thorp and I take a closer look at compliance-centric testimonial marketing and offer practical steps for getting started. We’re also covering how to build a testimonial marketing SOP backed by technology, and learning Google & Yelp’s policies to avoid hassles on your end.

Why Testimonial Marketing Isn't Going to Slow Down

My career has been spent working with financial advisors across many different technology lenses. And over the years, I’ve discovered testimonial marketing could be a powerful tool for financial advisors to build trust and credibility.

Now more than ever, it’s key to have positive reviews and testimonials from satisfied clients, since they’ll give potential investors confidence in the advisor. In fact, 81% of consumers in a January 2023 survey said online reviews were significant when choosing financial services. With online reviews, advisors can stand out in their local market or niche.

And when you think about the buyer’s journey, they only focus on two things: the facts and the emotions. A buyer will always check your credentials first—your educational background, what you’ve achieved in the past, and your years of experience.

And then they’ll put their emotions into play—what do others say about you? Who referred you? And are you a great financial advisor as you say you are?

Reviewing the SEC Marketing Rule & Recent Risk Alerts

Historically, the financial industry’s tight regulations have made it difficult to leverage testimonial marketing. However, the SEC has recently provided more flexibility to financial institutions when marketing their products.

The revised rule’s requirements for including testimonials and endorsements in advertisements are as follows:

- Make it clear that a current client or investor gave the testimonial, or someone else gave the endorsement;

- Clearly and prominently state whether the person giving the testimonial or endorsement got paid or not;

- Any material conflicts of interest stemming from the person’s relationship to the RIA should be transparently disclosed;

- RIAs can’t include testimonials or endorsements for which compensation was paid, unless the compensation terms are disclosed, including a description

To add, the latest Risk Alert posted June 8 2023 from SEC reiterated the importance of the following factors regarding testimonials and endorsements:

- Are disclosures provided? (The 3 C’s- Client, Compensation, Conflict of Interest)

- Are testimonials and endorsements compliant with the SEC Marketing Rule?

- Are written agreements executed with promoters of $1,000 in excess of de minimis compensation?

- Are ineligible persons compensated for testimonials or endorsements?

Besides all this, the SEC will also look at your Form ADV to see if that box is checked, indicating whether or not you’re using testimonials.

But Brian claims this is quite a trap—as even if you don’t have that box checked, they will expect no published testimonials. And if there are, they will most likely be questioned about whether or not they’re truly unsolicited. So how do you approach this issue?

Advisor Registration Matters

From a registration perspective, the SEC marketing rule is only applicable to SEC-registered investment advisors, while registered representatives are subject to FINRA oversight and a similar testimonial rule. However, there are now a few US states that are all synced up.

Advisors who are licensed by their states are subject to guidance from their state regulators and are ready to utilize testimonial marketing as well—so long as they follow the SEC guidelines. NASAA may also offer model guidance with the SEC rules as a foundation which many states may follow.

Registered representatives under FINRA have had the opportunity to start testimonials for quite some time. But it’s been challenging to leverage this marketing approach.

The good news is FINRA Regulatory Notice 17-18 provides a framework for testimonials that fits neatly within the marketing rule guidelines. There are only a few disclosure requirements that are non-material from a CM standpoint though, but they remove complications that should help you stay compliant with FINRA and SEC rules.

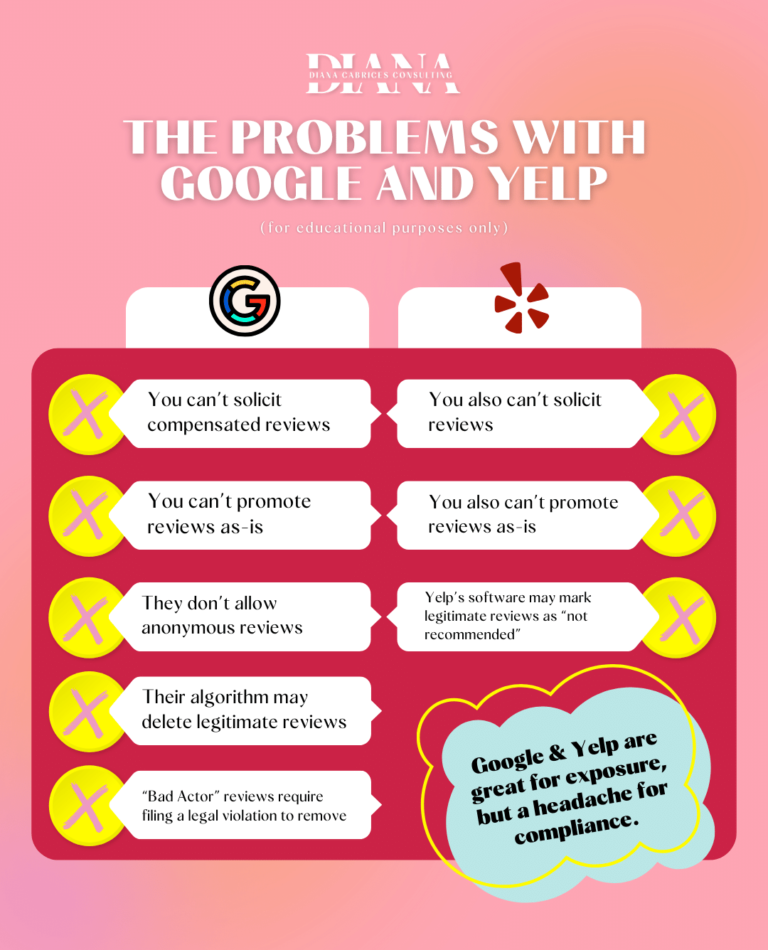

Why Yelp and Google are Difficult for Testimonial Marketing

Yelp and Google have strict review policies and algorithms that filter and moderate reviews, which can complicate testimonial marketing. Because of their strict guidelines, these platforms can be hard to control or showcase all testimonials effectively.

According to their policies, they might be difficult to use for these reasons:

In the finance industry, Google and Yelp policies prohibit businesses from soliciting compensated reviews. And beyond that, you can’t promote reviews unless they’re unsolicited. They filter reviews that seem suspicious or violate their policies, which might hide or remove genuine testimonials. It’s tough to curate testimonials for marketing purposes when you don’t have control.

Taking this a step further, Google specifically doesn’t allow anonymous feedback, even though the SEC marketing rules permit this. To add, the algorithms they use to filter out fake or unreliable reviews aren’t reliable. It’s not always accurate and could mistakenly flag genuine testimonials, resulting in them being excluded.

However, Wealthtender ensures that reviews submitted are from real clients, prospects, or partners, even though they can be publicly anonymous. To do this, we require certain information such as their email address and relationship status to help us incorporate the proper disclosures.

To offer you more guidance about Google Reviews, you can read about FINRA Regulatory Notice 17-18 here. The SEC will also consider updating the marketing rule FAQ to address this.

Using Technology to Build Your Compliance SOP

We know that when working and managing compliance for several advisors, SOPs could not be more significant. Advisors will likely have to follow a solid process to be compliant.

And it’s not just with the regulators, this also applies to your firm as well. It’s for this reason that technology is an integral part of compliance across all processes.

To this end, Wealthtender is the first SEC-compliant testimonial marketing platform for advisors that allows advisors to share their successes with their clients. We launched the Certified Advisor Reviews platform to fill in the void in the marketplace due to the shortcomings of traditional review platforms.

Designed for SEC compliance, the Certified Advisor Reviews platform allows advisors to collect and promote SEC-compliant reviews on their own website and on the Wealthtender profile page. We prioritize transparency over stress in following regulatory guidelines. We’ve created this strategy to help our clients feel more informed and educated when reading these reviews, and give them the confidence to reach out to potential leads.

So how does the Certified Advisor Reviews platform work when a review is submitted on a Wealthtender profile page?

- First, the advisor is notified by email. They can review details in the email, with a link to the certification form.

- Then, they reply with the required disclosures. They answer the 3 C’s—client, compensation, and conflicts of interest. Are they reviewing a client’s review, or a non-client’s review? Are they compensated for sending this review? And are material conflicts involved?

- Finally, the form is submitted to Wealthtender and the review is published.

How to Request Testimonials

Did you know that over 60% of consumers are more likely to write a review after an awesome experience with a business? This holds especially true when the business follows up with a link in an email asking for one.

Here are my suggestions for advisors on how to request testimonials successfully:

- Consult your CCO (Chief Compliance Officer) first. Ask them about the company’s testimonial policy. Let them know why you’re requesting testimonials and who you intend to use them for.

- Send an email asking for a review to all of your current clients. This mitigates the risk of SEC cherry-picking concerns, and these reviews – once obtained – will help prospects learn about the client experience.

- Consider inviting influential non-clients who respect you to write a review. These can be people who are specialists in your niche, industry experts, or people from non-profit organizations. These reviews can help prospects learn about your character and build trust in your brand. They can also help boost your visibility in search engine results.

- Include a link to the review page in your email signature. If you’re on Wealthtender, we give you a QR code that can also be inserted into your email signature.

- Add a section to your newsletter asking for a review. By creating an easy way for customers to leave a review, you’ll build credibility with potential customers.

- Create an instructional flyer for your office. This flyer should explain how to access your Wealthtender page, using a QR code so people can easily access it with their smartphones. Make sure to include a call-to-action in the flyer, encouraging customers to leave a review.

- Build a dedicated section on your website for reviews. Wealthtender can help you with their dedicated embed widget. The widget pulls out all the reviews from your Wealthtender page and displays them in an attractive list.

- Incorporate a request into your client review. This will help you create a consistent and positive online reputation for your firm. Customers will be able to access all reviews easily and make informed decisions.

- Propose a charitable donation as compensation. This can be a very effective way to show your clients that you appreciate their loyalty and value their contribution to your business.

In Summary

There’s no end to testimonials and reviews in the financial services industry for both consumers and advisors. It’s only going to grow with more demands, and will become an integral part of the consumer-buyer journey when searching for advisors.

At the same time, since the SEC released their updated marketing rule, people have been all over the place about how to implement it correctly. Some compliance teams just send nothing outright, and that results in advisors dropping out as they get no support in growing their business.

That’s why Wealthtender’s technology-backed testimonial marketing platform is an obvious choice when consdering how to implement testimonial marketing for advisors. With Wealthtender, advisors can share their successes with their clients sans the compliance headache, and compliance teams can rest assured they have a solid process in place to support this.

To learn more about our compliant testimonial marketing platform, go to wealthtender.com/diana.