What if you could triple your referrals as a financial advisor?

Many advisors rely on traditional marketing strategies to grow their client base, but they often overlook one of the most powerful tools at their disposal—client referrals. Turning clients into full-blown brand advocates that refer business to you is definitely possible, but you have to be intentional about it.

In this guide, David DeCelle from ModelFA, a partner of Wealthtender, and I teach you easy-to-implement formulas and ideas that’ll help you get more referrals. Our focus will be on actionable takeaways you can implement right now, like the “C3” mindset, enhancing client experiences (CX), and amplifying your clients’ stories. Read on!

Three Challenges Advisors Have to Overcome To Land More Referrals

1) The Client Experience Hurdle

Financial advisors often have their service models well buttoned up, according to DeCelle. They know exactly what a client is going to go through from introduction to onboarding and beyond.

But having a well-defined experience model allows for better growth and improvement.

Referring people doesn’t happen because you meet the expectations of them, but because you surpass those expectations. And if you stop at your service model, that’s just meeting their expectations.

When you layer on that experience model, that’s when you start to exceed them. That’s when referrals start to happen, and customers start to become deeply connected to your brand… That’s when you have built a sustainable business.

2) The Assumption That Relationships Will Grow Organically

As you think through the clients that you would love to get referrals from, you probably have that moment where you realize you haven’t chatted with them in 3-4 months. Because we’re always busy, we need to figure out how to interact with our clients often in a scalable way and create a system.

Your chosen platform is one of the best tools in your advisor tech tool kit that reminds you when you need to reach out to a client about their semi-annual review, or whatever your review cycle is. A similar system is also needed for the experience component.

3) The Desire for Immediate Results

Often, achieving a result takes time. Like going to the gym, it takes months for you to meet your target weight or body goals. You need to be persistent every day.

Much like a workout, marketing strategies also take time to enjoy its results. We have to be okay with a little bit of delayed gratification and see things through before we get what we want. Because without patience and dedication, we won’t see the results we’re looking for.

The Three Solutions to Overcome These Challenges

1) Combine Client Experience With Your Client Service Model

It’s important for financial advisors to prioritize providing personalized, customer-centric service. The best way to do this is to understand what your clients’ unique needs, goals, and preferences are, and to adjust your service accordingly.

Financial advisors can build trust and credibility by meeting regularly with clients, being available to answer questions or concerns, and being transparent about expectations. Even just picking up the phone to call a client and say hello goes a long way (and as David mentions in our webinar, on their birthday especially!).

You can even send them a link of your reviews, so your clients can see what others are saying. Educating your current clients about other clients’ experiences will undoubtedly grow your business. It’s storytelling at its finest. People are always motivated by other people’s actions.

2) Advance Relationships in a Systematic Way

We often think that prospect or client relationships happen organically, but building and growing them is best done when you have a system around it, especially when you’ve impacted them immensely with client experience.

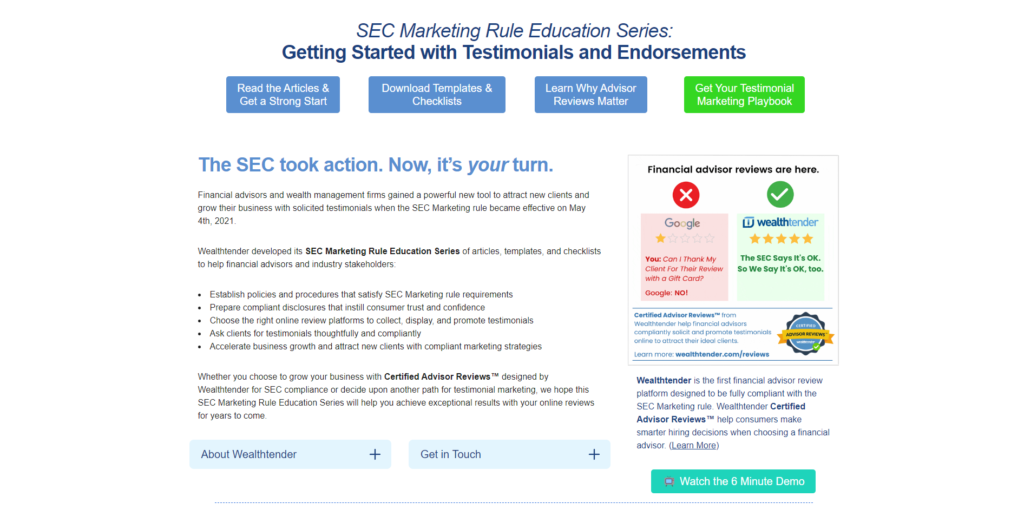

Platforms like Wealthtender can help you simplify your client experience with its features fit for the everyday financial advisor. Wealthtender steamlines the outreach process by educating your audience with helpful financial content and telling better stories through online reviews.

And speaking of reviews, the shortcomings of traditional review sources has inspired Wealthtender to create the Certified Advisor Reviews platform as a bridge in the financial advisory space. Besides your experience and credentials, online reviews from your clients establish an emotional connection with prospects, which helps them feel more confident.

Moreover, Wealthtender’s SEC Marketing Rule Education Series provides articles, templates, and checklists to help you promote SEC-compliant reviews on your own website and on Wealthtender’s profile page. Wealthtender reviews can increase your confidence when contacting potential leads.

The combination of an exceptional online reviews platform plus a well-crafted client experience helps you prime your clients to easily make or give referrals.

3) Apply the “C3” Mindset: Commitment, Consistency, and Confidence

The key to boosting your referral count lies in adopting a “C3” mindset shift, according to David Decelle, CEO of ModelFA.

What does “C3” stand for? It’s simple: Commitment, Consistency, and Confidence.

When these three elements are deeply ingrained in how you operate your financial advisory practice, the result is a loyal client base that feels valued and is more likely to refer others to you.

- Commitment is the foundation. Make sure you’re doing everything you can to help your clients, going above and beyond with personal advice and solutions.

- Consistency is just as important. Consistently deliver high-quality service, communication, and follow-ups. Clients feel secure in their relationship with you when you’re consistent. When they need you, they know they can count on you, and they want others to feel the same way.

- Confidence ties it all together. Having confidence in what you do and what your value is essential to retaining clients. If you project confidence in your abilities, clients feel reassured that they’re in good hands, which makes them more likely to recommend you.

It Isn’t Just Possible, It’s Doable

Getting three times as many referrals as a financial advisor isn’t just possible, it’s doable.

With the strategies outlined in this guide, you can turn your prospects and clients into enthusiastic advocates for your brand, generating referrals for you.

Explore ModelFA’s coaching platform for independent financial advisors here. And don’t forget to compliment the marketing foundations you build with ModelFA with Wealthtender; learn more at https://wealthtender.com/grow/