When it comes to finding prospects, the struggle is real – especially in the first 5 years of any financial advisor career.

But with the introduction of artificial intelligence, financial advisors can gain a competitive edge by identifying prospects with favorable financial situations, and who are also actively in need of advice.

Rylan Folts, Co-founder of Wealthfeed, an AI-powered platform providing real-time money-in-motion data, and I share our insights into prospecting and why advisors should turn to AI to convert and capture new prospects.

What Is Money in Motion?

Based on general research, it’s not uncommon that a person switches their advisory firm due to a catalyst event in their life.

Catalyst events are highly emotional events. These include:

- An unfortunate experience

- Retirement

- Marriage

- A change in financial status

These are usually major milestones in your life that put your “money in motion”.

And when you really consider how advisors grow, it’s never random for a prospect to hire an advisory firm. It is usually these catalyst events that make a prospect consider seeking an advisor’s help.

Money in motion is pivotal for advisors because it strengthens their relationships with their clients. It touches on psychological marketing, almost. This creates an opportunity for advisors to demonstrate their expertise, provide personalized solutions, and build trust with their clients, fostering long-term relationships.

How AI Can Help You Acquire Clients

We’ve established that life is full of catalyst events. So, as advisors, how can we leverage this to acquire new clients?

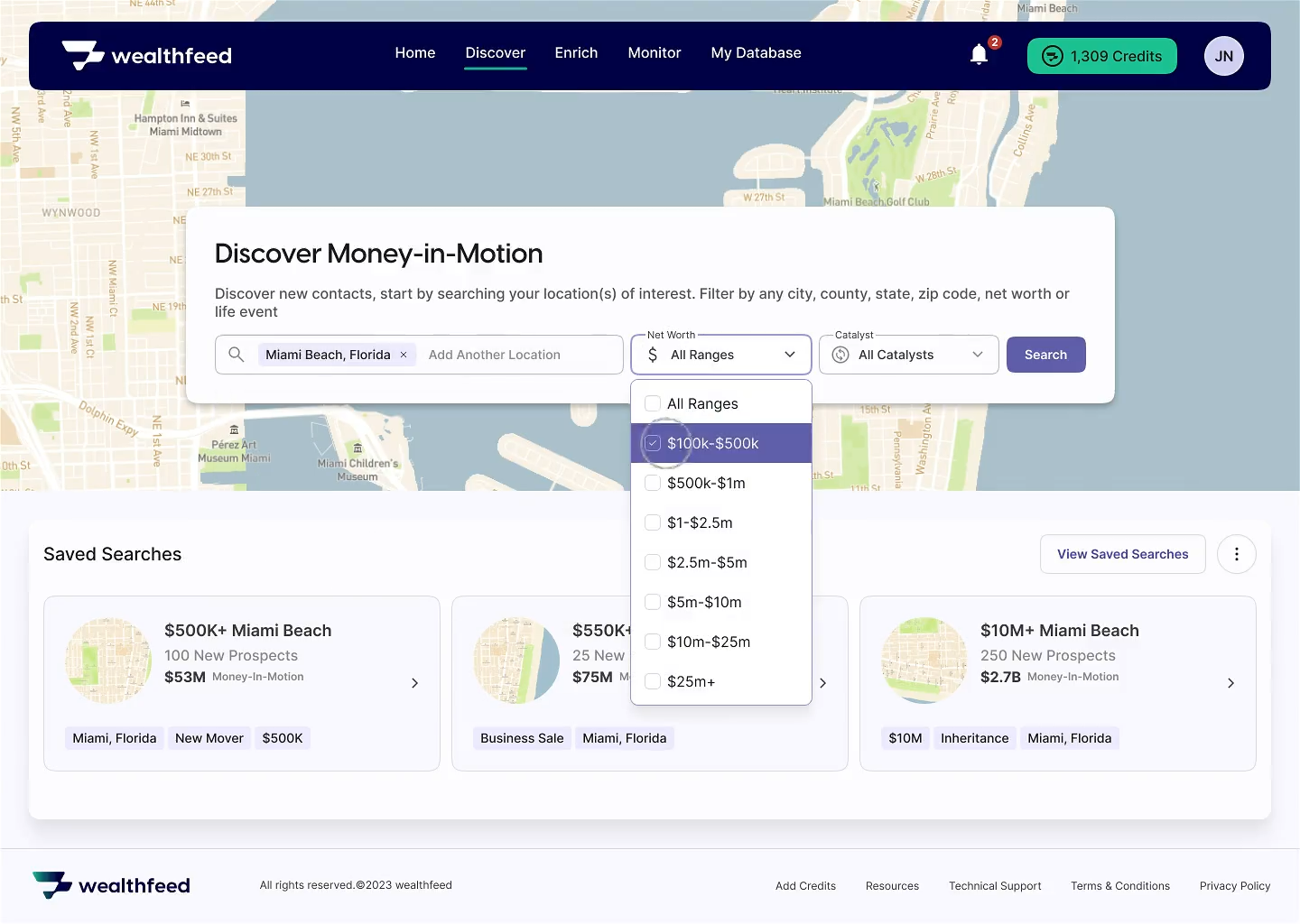

With the use of AI, Wealthfeed has created a tool that helps advisors identify and track catalyst events. This is done through analysing and identifying patterns in vast amounts of data.

As a platform that provides real-time money-in-motion data, it gives advisors these opportunities:

- Unlock the potential of the $129 Trillion Wealth Transfer and more

- Leverage big data and AI to identify millions of HNW individuals with money in motion

- Help financial advisors make the initial contact and on-going engagement with these individuals

Wealthfeed allows you to quickly find a niche, saving you time building that audience. It hits two birds with one stone – not only are you scoring clients with money in motion, but you’re also finding clients ideal for you. You can filter according to age, demographic, employment status, occupation, life events, and more.

Overall, Wealthfeed accumulates a list of potential clients you can reach out to and stick with for your marketing campaigns. To learn more about the platform, go to wealthfeed.com, and if you’re interested in investing in the platform, use coupon code “Wealthtender” to get 50% off!

Moving To The Next Step

Now that you’ve used Wealthfeed to its full potential to help you discover clients, what’s next?

The next step is to engage with those clients and build a strong relationship with them. Wealthfeed’s notable feature helps you do this is sending handwritten notes.

Wealthfeed uses advanced handwriting machines that use real pens and ink to craft your personalized note. Their tech ensures the note is completely unique and looks authentic. Sending handwritten notes to clients creates a personal and genuine connection, showing them that you value their business and care about their success.

Now some may think this strategy is creepy or invasive, but simply put, it works. Because these days when someone receives a handwritten note from someone they don’t initially know, they’ll Google your name first and find out who you are.

It’s here where an financial advisor’s digital footprint really matters (and those who have made an impact online will win).

How Wealthtender Grows Your Digital Footprint

Most of us advisors have a website, a social media presence, maybe even a podcast episode or two. These platforms are where we all begin to grow our footprint in the digital world to attract prospects.

But most of us don’t have a web listing, don’t dabble in online reviews (just yet!), and very few are mentioned or featured in blogs and other publications.

This is where Wealthtender comes in.

Paid listings, for example, allow you to reach a wider audience, gain credibility, and increase your visibility in the financial space. And given the updated SEC rules for testimonial marketing, Wealthtender now makes it faster for advisors like you to target an audience of potential customers, allowing you to easily connect with the right prospects.

Grow your digital footprint with Wealthtender at wealthtender.com/grow, and make sure to use coupon code “Wealthfeed” for 50% off as well!