As a financial advisor, you’ve likely been advised to incorporate estate planning into your advisory firm’s service offerings. And for good reason—it’s a major differentiator that clients actively seek.

With a staggering 60% of Americans still without an estate plan, the opportunity for financial advisors to make a real impact is enormous. Not only can you provide immense value to your clients, but this untapped market is also a fantastic way to attract new prospects to your advisory business.

However, let’s face it—offering estate planning services is only half the battle. How well you market these services will determine your success.

I recently teamed up with Trust & Will to deliver an “everything you need to know” session on 5 marketing tactics to promote your estate planning services, designed to help you elevate your offerings and stand out in a competitive market.

Even if you haven’t yet incorporated estate planning into your services, this blog is the perfect starting point. You’ll gain valuable insights and tools to seamlessly integrate estate planning into your advisory firm. Here are the highlights and takeaways:

Why Investing in Estate Planning Makes Sense Now

Usually, the largest financial transaction of your life is the one you are least prepared for. Most people leave behind their assets, as well as their legacies, to lengthy, expensive, and complex legal processes.

So why don’t more Americans have an estate plan?

- Lack of educational resources: Your prospects may not understand the risks of not having a basic plan.

- Procrastination: Most people avoid discussing end of life issues.

- Prohibitive costs: The cost of an attorney can range from thousands of dollars and this can be a financial burden for many families.

- Accessibility: People struggle to know who to trust to do things right.

But a surprising fact to add to this is that holistic planning from financial advisors has increased 60% since 2018, with legal services (inclusive of estate planning) being what clients value the most. This indicates that clients now recognize the importance of a well-rounded financial plan.

So as a financial advisor, your role is to be the heart and center of your clients’ financial well-being. When you start talking about estate planning with your clients, you will uncover more assets they want your help with. Your job is to ensure their financial goals are met in life and beyond.

The Best Ways to Market Estate Planning

Now that you understand the importance of the topic, let’s shift into how you can best market your estate planning offer.

1. Educate Prospects & Clients on Social Media

Social media is undoubtedly one of the most valuable places to position yourself as an educator in estate planning. With so many people using social media, it’s a great opportunity to start conversations around estate planning and the benefits that come with it.

Here’s how to start:

- Focus on the basic concepts of estate planning (i.e. what is a will?) and debunk common misconceptions.

- Tailor your messaging to your audience—if you target business owners, LinkedIn is the place to be. Millennials? Instagram.

- Make your branding approachable by adding yourself to it—it can be a selfie from a recent trip, or photos of you and your family. This should be tied into your education.

- Leverage Trust & Will’s rich library of estate planning content (including a branding toolkit) and add your own spin to them.

2. Humanize Your Offer With Video

Today, people crave authenticity and personal connections more than ever. That’s why video is one of the most effective ways to make your content more relatable and show your audience how much you genuinely care about helping them.

It’s not just about telling people why estate planning is important—it’s about showing them, with sincerity and empathy, that you’re the right person to guide them through the process.

Here are some tips to get started with your videos:

- Videos should be short and sweet, no longer than 2 minutes.

- Offer tips, break down complex estate concepts into easy-to-understand takeaways, and highlight the key benefits of estate planning in a way that speaks to your audience’s needs.

- Remind them why acting now is critical—perhaps estate planning can prevent legal headaches, protect loved ones, or avoid future financial worries. Make them feel like this is a step they can’t afford to delay.

- Film in your phone’s cinematic mode horizontally. Blurring the background helps focus on you, so you’re more engaging to watch.

- Record in front of a window. Don’t use harsh artificial light or sit with the light source behind you, as it can create unflattering shadows.

A sample video script like this below would be a great starting point when you want to create an engaging video—feel free to work around this as you wish!

3. Get Conversational With Email

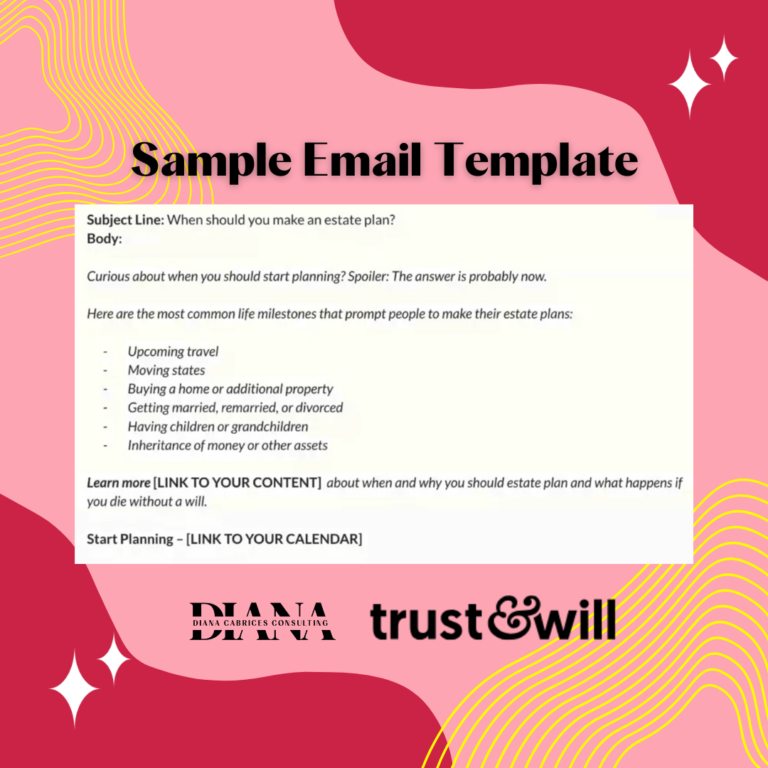

Email is a powerful tool for building relationships. When using email for your outreach efforts, considering the following:

- Send personal, educated emails on why the topic is important.

- Keep your copy and design as simple as possible so it looks more approachable.

- Include questions in your email to drive curiosity, which will lead people to respond or take action. For example, “What’s holding you back from creating your estate plan in the next 30 days?”

- Leverage Trust & Will’s free email templates, and check out our campaign with Snappy Kraken.

4. Meet New Estate Planning Prospects With Events and Stories

Here’s the thing: event marketing is unique. With event marketing, you get to meet new prospects and engage with new clients. And when you host an event, your goal isn’t just to gather a ton of people in a room—it’s to educate them and position yourself as a thought leader and a storyteller.

As someone who’s helped a lot of advisors host successful events in the past, here are a few tips I’d like to share to help you move forward:

- Get face-to-face with educational seminars and/or webinars. Don’t be afraid to host client estate planning events!

- Start your event with a good story, but not your own. Use stories from inspirational people you know to grab people’s attention immediately (Prince’s estate story is a jaw-dropper!).

- If you’re a Trust & Will client, use Trust & Will’s Free Estate Planning 101 deck and present it in a way that’s unique to you. (You can sample the deck here)

5. Turn Your Website Into an Educational Hub for Estate Planning

Turning your website into an educational resource builds trust and establishes authority in your industry, not just your brand.

When it comes to estate planning, make your content clear, accessible, and easy to read. Put together a blog post, a guide, or even an interactive tool to cover legal basics like wills, trusts, and estate planning. With this content, you not only position yourself as a thought leader, but you also make your site a valuable resource for prospects and clients alike.

Also, make sure to include strategic keywords or frequently asked questions on the topic in your blog posts and guides, but don’t forget to prioritize quality and clarity. Your content should also have a call-to-action (CTA) that encourages readers to learn more, contact you, or sign up.

Don’t forget about videos! It’s also a great medium for teaching. The more personal they are, the more likely people are to reach out to you.

Last but not least, take a cue from industry leaders who have made their websites into educational resources. Try looking at how Trust & Will advisors (see below) use their website if you’re in financial or legal advisory. Using educational content and call-to-actions, they turn visitors into clients by addressing their needs.

- Woodson Wealth Management — makes the process very clear

- Behm Financial — rich content library of education

- Intellicapital Advisors — uses Trust & Will videos

- Holistic Financial Planning — buckets estate planning under retirement services

In Summary

The ability to incorporate estate planning into your services is a big differentiator that consumers seek out. Estate planning isn’t just important to upgrade your firm’s offerings, but it will help you attract new business.

However, the real key to success lies in how well you position and promote this service to your audience.

So are you ready to make estate planning a cornerstone of your advisory firm? Learn more at https://trustandwill.com/advisors/ or schedule your free, 1-1 strategy demo here.