Today, advisors face a lot of challenges aligning their services with investors’ unique needs. Advisors can deliver better results by understanding what makes customers tick — their goals, concerns, and priorities.

Enter the Passport Package Assessment, a revolutionary, patent-pending tool designed to help advisors identify and address their clients’ core mindsets.

Katie Braden of C&J Innovations and I recently demoed the assessment live, explaining how it can drive growth by uncovering the 5 core client mindsets that can transform advisor-client relationships. Here’s how this assessment, combined with lead generation, can help you better meet the core needs of your clients.

The Five Core Mindsets & Their Superpowers

Your goal as financial advisors is to always keep a growth mindset – to collaborate with people and add value. The Five Core Client Mindsets help you achieve this by advisors by tailoring your strategies to fit the specific needs and preferences of your clients, which starts with deeper understanding.

The Readiness Mindset

With a readiness mindset, your clients are prepared to face unforeseen financial challenges with confidence by having a buffer. But what does a “buffer” mean?

Basically, a buffer is something you keep in savings or income to cover unexpected costs. Your clients will feel better knowing they have a buffer in case they run into financial trouble.

The Caring Mindset

The caring mindset ensures that passwords, directives, and other important documents are accessible to your clients’ families.

For instance, advisors can help clients create a digital vault where they store important documents and passwords. This way, if something happens, family members can get the info they need to manage their loved one’s affairs. In financial planning, this shows a lot of care and foresight.

The Foundation Mindset

Having a Foundation mindset encourages your clients to set up key protections for themselves and their loved ones. These protections could include life insurance, disability insurance, and retirement savings. Protecting your clients in this way ensures their confidence and helps them feel secure.

The Wellness Mindset

Are your clients getting regular checkups? Are they proactive about their health?

In order to live a life they envision, make mental and physical health a priority in your client’s daily routines. The goal is to help them develop sustainable and realistic healthy habits, so they can be financially ready for whatever happens in the future. It also means providing them with the resources and support they need to be secure.

The Partnership Mindset

The Partnership mindset works to establish trust between you and your clients. Does your client want to work with you? What’s stopping them? It’s a good idea to ask these questions to get a feel for the client’s perspective and identify areas to work on together. It takes understanding and collaboration to create an environment of partnership.

But Wait, There's More - The Expansion Mindsets

Depending on where a client is at their life cycle, how will your approach change? Let’s talk about the Expansion Mindsets and why they matter.

The Resource Mindset

Apple Pay and credit cards are cool, but do we keep track of what we spend with them?

In order to maintain a resource mindset, it’s critical to track expenses and monitor cash flow proactively. In this way, clients can be efficient in identifying potential savings and ensuring resources aren’t wasted. Our goal is to inform our clients about where their money is going, and to make sure their values and life goals align.

The Accumulation Mindset

The accumulation mindset encourages your clients to focus on saving money to achieve their life goals. Saving for emergencies, investing in retirement accounts, and creating a budget are all vital steps to consider. You should also help your clients reduce debt and increase their income.

The Walkaway Mindset

With the Walkaway mindset, you can help your clients plan for the future and save for retirement. Here, your clients are now walking away from everything they’ve done for others so far so they can focus on themselves. Three superpowers come with the Walkaway mindset:

- The Longevity mindset underscores the importance of having a system in place for your clients to ensure they are cared for as they wish.

- The Income mindset guides your clients to have a plan for creating income after walking away from their current career or business.

- The Purpose mindset prepares your clients for a clear, purpose-driven vision and plan for their “next chapter.”

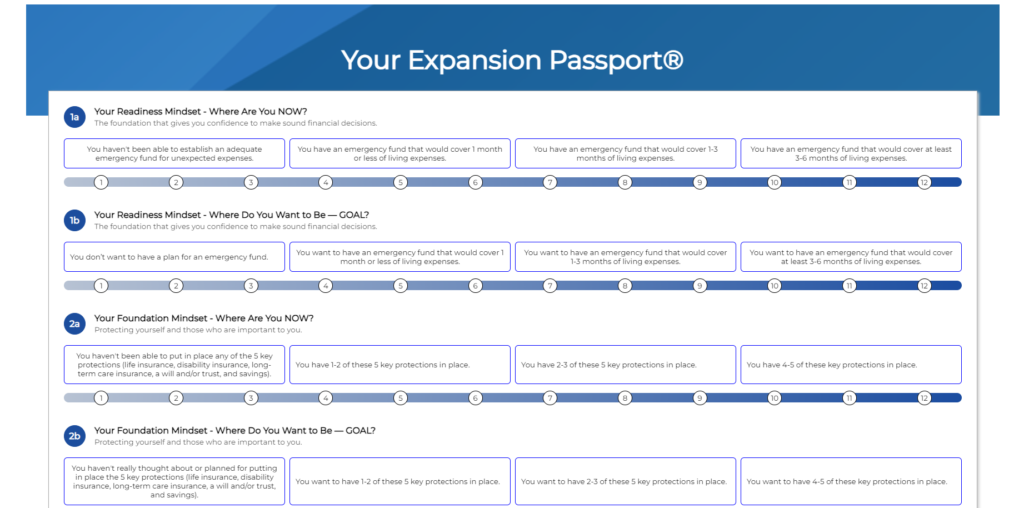

The Passport Package Assessment

Some of the key questions you’d ask your clients when you want to get to know them better are, “Where are you at now in life?”, and “Where do you want to take things from here?”

The Passport Package Assessment by C&J Innovations is a groundbreaking tool that helps advisors understand and address clients’ core mindsets. There’s the Expansion Passport created for ages 20 to 45, and the Walkaway Passport intended for ages 45 and up.

Katie shows the demo in the webinar linked at the top of this page. She outlines the features and benefits of each passport and explains how they can be used to help advisors create tailored strategies for their clients. You can also watch it here.

Turning Leads into Prospects With Wealthtender

Consumers come in every month to search for financial advisors on the Wealthtender platform. However, one question we sometimes get from advisors on the platform is, “How do I follow up?”

There are dozens of strategies to follow up on your clients and engage with them – which I’m sure many of us already use – but the Passport Package Assessment, combined with Wealthtender’s features, will step up your lead generation game.

Here are ways to share the assessment and take the next step:

- Send it directly via email

- Route your Calendly booking page to land on it (Wealthtender users have this linked)

- Include it as a QR code in your email signature

- Add the QR code to marketing materials

- Send the link via text as a conversation follow-up

I’ve shared more tips on this in my recent blog here where I collaborated with David DeCelle from ModelFA! Check it out when you can.

The Bottom Line

The success of our clients depends on how well we understand their goals and priorities.

With the Passport Package Assessment, advisors can tailor their services with precision and foresight by identifying core client mindsets.

The combination of this powerful tool and Wealthtender’s lead generation features will help you increase prospecting and conversion rates.

As advisors, we always seek ways to grow and provide more value. If you’re interested in putting yourself out there to get more leads in the door, visit wealthtender.com/grow and use coupon code FIFTYOFF for 50% off your first two months on the platform.

Feel free to explore the Passport Package Assessment as well at https://candjinnovations.com/, and don’t forget to mention this webinar for $1,000 off the setup fee!